A step by step guide to adding a share grant to your Secfi account

This article covers the steps for adding a share grant to your Secfi account.

If you have linked your Carta account to Secfi, your shares will be automatically imported.

Shares can be acquired in multiple ways

- ISO or NSO: Exercising vested options for your Incentive Stock Options (ISO) or Non-qualified stock option (NSO) grant converts them to shares that you own. Typically, you would pay cash to exercise your options. In some cases, if the company is public or has a tender offer, you might be able to do a cashless exercise.

- RSU: Restricted Stock Units (RSU) convert to shares when they vest and all trigger conditions are met. Typically, RSUs have either a single or double trigger. For double trigger RSUs, the second vesting condition is usually an exit event such as an IPO or acquisition.

- Secondary market: You can buy shares of pre-IPO companies on secondary exchanges like Caplight, Zanbato, Forge, or similar platforms.

- Direct issuance of share grants is also possible. Founders may receive founder shares or Restricted Stock Awards (RSAs). Startup investors may receive preferred shares in exchange for their investment in the company.

- Shares for publicly traded companies can be directly purchased. If you have purchased shares directly from a publicly traded company, you do not need to follow the steps in this article.

Before you begin, ensure that you are logged into your Secfi account. If you are uncertain about how to begin adding share grants, simply click on your profile icon located at the top right corner of the screen and select 'Equity details'.

Adding shares from ISO or NSO grants

You have the option to add shares to an existing grant in your Secfi account or create a new grant altogether.

If this is the first time you are adding equity for a company, follow the steps in this guide.

Adding shares to an existing grant

Select the company that you would like to add a share grant for and then click on 'Add an exercise'

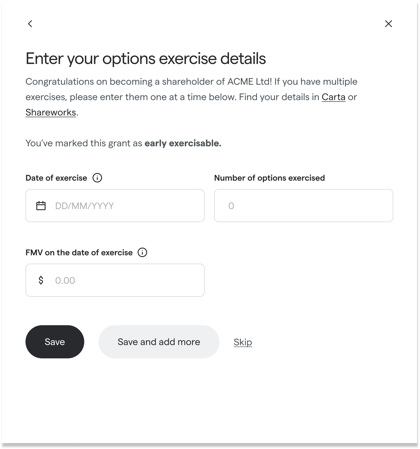

Enter the exercise details

If you have indicated that your grant is early exercisable, you can add an exercise even if no options have vested yet.

If you have multiple exercises, you can enter them one at a time.

After entering your exercise information, you can choose from the following options:

- Save: Select this option if you have finished adding all of your exercises.

- Save and add more: Select this option if you have multiple exercises and want to add another one.

- Skip: Select this option if you do not wish to add an exercise.

Note that the total number of exercised options cannot exceed:

Note that the total number of exercised options cannot exceed:

- The total number of options vested as of the date of exercise, if early exercise is not allowed.

- The total number of options granted, if early exercise is allowed.

Adding shares as a new grant

Select the company that you would like to add a share grant for and then click on 'Add a grant'

Please follow steps 2 to 5 in this guide to finish adding your share grant.

Adding shares from a RSU grant

Unlike option grants (ISOs or NSOs), RSU grants do not need to be exercised. If you have already added your RSU grant to your Secfi account, you do not need to do anything more. If you have not added the RSU grant, please follow steps 2 to 5 in this guide to add shares from your RSU grant.

Adding shares from secondary markets

To add shares acquired from a secondary market, select 'Manually add equity details' and select the company the shares are from.

When prompted to select the type of grant, select 'Shares' and then select 'Secondary market'

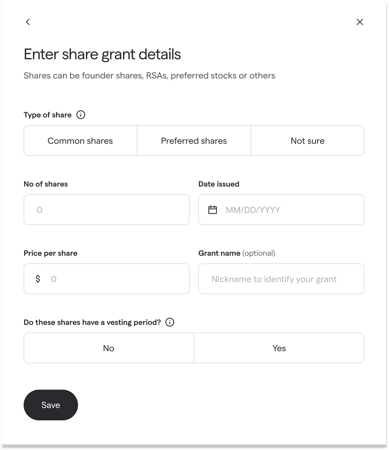

Enter the details for the shares purchased through the secondary market. You can purchase common or preferred shares. If you are unsure, select 'Not Sure'. When you are done, click Save.

Your secondary market shares are now added to your Secfi account 🎉

Adding shares from other sources

If you have obtained shares as a founder or early employee of a company, or if you are an investor, you have the ability to add those shares to your Secfi account. Additionally, if you have acquired shares from sources that do not fit into any of the options mentioned earlier (such as ISO/NSO grant, RSU grant, or secondary market), you can still add those shares using this process.

Select 'Manually add equity details' and select the company the shares are from.

When prompted to select the type of grant, select 'Shares' and then select 'Other'

Enter the share grant details

Founder shares are usually common shares.

Preferred shares are typically issued to investors. Preferred shares entail no voting rights. In the event of liquidation, they hold priority over common shareholders.

If you are unsure, select 'Not Sure'

If your share grant comes with a vesting schedule, select 'Yes' for 'Do these shares have a vesting period?'

Enter all your grant information to move to the next step.

If prompted to add a vesting schedule, please select the option that aligns with the vesting schedule for the grant. The most common vesting schedules are:

- 48 months with a 1-year cliff, and

- 48 months without a cliff.

If neither of these applies to your grant, please select 'Other'.

If you have a cliff, select the vesting frequency after the cliff. For example, if your vesting schedule is the following, select 'Monthly' for 'How often do your stocks vest?'

|

Cliff |

Yes, 25% vests at 1 year |

|---|---|

|

Vesting |

After the cliff, the remainder of the shares will vest monthly on the last day of the month for the remaining 36 months. |

'Save' your vesting details to finish adding the grant.

Once you have successfully completed all the steps above, your shares are now available across the Secfi platform 😊 🎉