A step by step guide to adding ISOs, NSOs and RSUs to your Secfi account

To effectively utilize the Secfi platform, it is essential to ensure that you have entered your equity details accurately. Whether you are creating a plan, seeking financing, or managing your wealth, you can easily add and control your equity information within the specific product you are using.

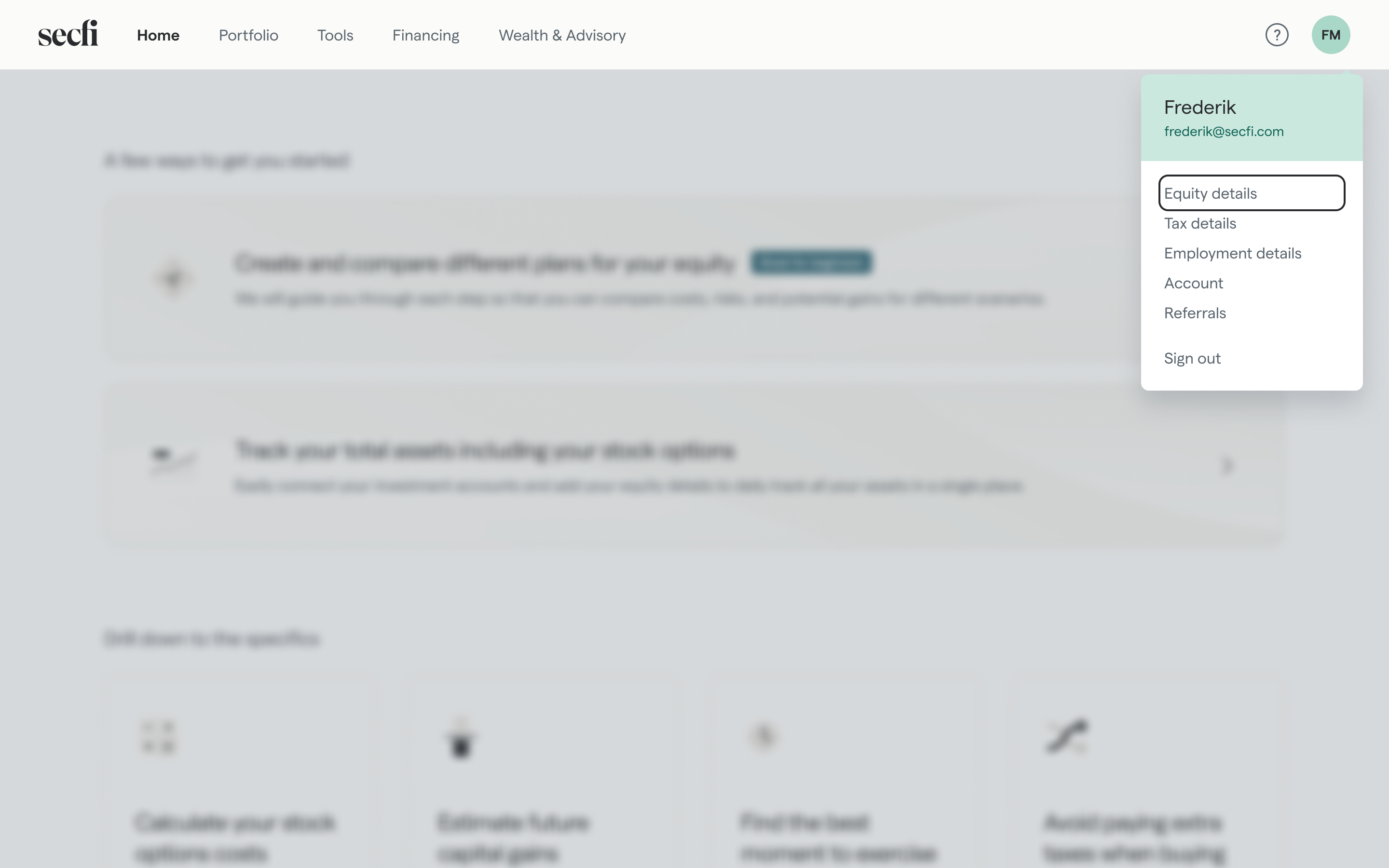

Before you begin, ensure that you are logged into your Secfi account. If you are uncertain about how to begin adding your equity, simply click on your profile icon located at the top right corner of the screen and select 'Equity details'.

Add equity by linking your Carta account

If this is the first time you are adding equity for a company, you can start by selecting how you would like to add your equity information.

Linking your Carta account

If your company works with Carta, linking your Carta account is the easiest and most secure way to add your equity details to Secfi. There a multiple advantages to linking your Carta account:

multiple advantages to linking your Carta account:

- It's fast: With just two clicks, you can link all your equity information to Secfi within seconds.

- It's safe: We use Carta APIs to enable secure login to your Carta account. This means that Secfi does not have access to your Carta credentials.

- It's accurate: Equity can be complicated, and remembering all the details such as vesting schedules, cliffs, strike price, FMV at exercise, etc. can be challenging. With Carta, you don't need to remember any of these details to add equity to Secfi.

- Refreshed automatically: Your equity information will be automatically updated at all times. No more worrying about stock splits, new grants, or adding recently exercised options.

To link your Carta account,

- Select "Connect your account" and then click "Take me to Carta".

- You will be redirected to Carta to securely log in to your account.

- Enter your Carta login ID and password, and click "Log In". If you have set up two-step verification on Carta, you may be prompted to enter an authentication code.

If you face any issues while logging in, please refer to Carta's troubleshooting guide.

Once you have successfully logged in and authorised access, all your equity data will be automatically imported to Secfi.

Upload a document

If your company uses Shareworks or other equity management platform, you can upload your equity or share documents and we will extract the relevant equity information. This is an easy way to have your equity data entered.

You can download or take a screenshot of your equity or share grants from your equity platform.

To upload your documents,

- Select "Upload a document and we will scan it".

- Then drag your documents and click next.

- Verify that the data extracted from the documents looks correct.

Add equity manually

If your company uses Shareworks or other equity management platform, you will need to add your equity manually.

Before you begin, make sure you have all the information related to your grants readily available. To access the specific information about your grant, you can refer to our guide for Shareworks or Carta.

1. Select company

To start adding your equity, you have to start by selecting the company that the equity is from. If this is the first time you are adding equity for a company, you have to start by adding the company.

Add a new company

Once you've selected the company, you'll need to enter the company's valuation and employment details. These details help us estimate taxes for exercise or sale events.

Add valuation: Enter your company's valuation details

- The most recent 409A/FMV(Fair Market Value) is the current value of one share of common stock. You can find it in Carta or Shareworks or request it from your company.

- The most recent Pref price (Preferred price) is what investors paid for one share in the latest round of funding. You can find it on sites such as Pitchbook or Crunchbase.

Add employment details: To enter your employment information, select the country and city where you've lived the longest during your employment.

Once you've entered the details, click "Next: Add equity details"

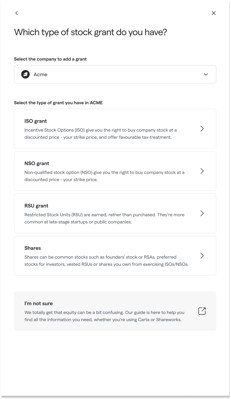

2. Select the type of grant

Next, select the type of grant that you want to add. You can add only one grant at a time.

If you acquired stocks from employment, your equity grant letter should mention the type of stock issued to you. Typically, early-stage pre-IPO companies issue Incentive Stock Options (ISO) or Non-qualified Stock Options (NSO). Late-stage pre-IPO companies usually issue Restricted Stock Units (RSUs).

If your employer issued a share grant that is not linked to an ISO, NSO, or RSU grant or if you purchased stocks in a pre-IPO company through a secondary market transaction, please read the guide to adding shares.

If you purchased shares directly for a publicly traded company, add them as assets to your Portfolio.

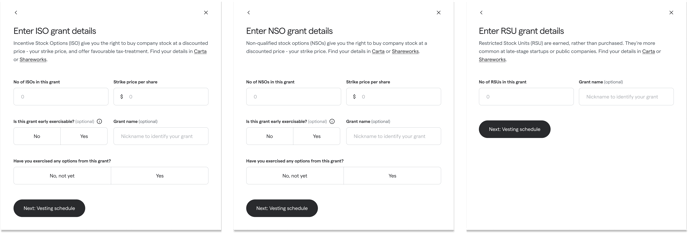

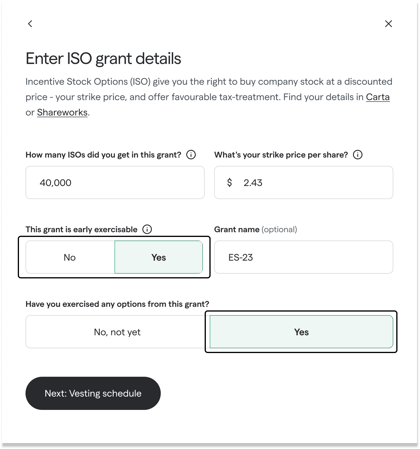

3. Enter grant details

Start by adding in the grant information.

We recommend that you add a "Grant name" to easily identify the grant when using our tools or requesting financing.

4. Enter vesting schedule

Please select the option that aligns with the vesting schedule for the grant. The most common vesting schedules are:

- 48 months with a 1-year cliff, and

- 48 months without a cliff.

If neither of these applies to your grant, please select 'Other'.

If you have a cliff, select the vesting frequency after the cliff. For example, if your vesting schedule is the following, select 'Monthly' for 'How often do your stocks vest?'

|

Cliff |

Yes, 25% vests at 1 year |

|---|---|

|

Vesting |

After the cliff, the remainder of the shares will vest monthly on the last day of the month for the remaining 36 months. |

If you have exercised options from an ISO or NSO grant, you will be prompted to add those exercised options next. Otherwise, you can simply 'Save' your vesting details to finish adding the grant.

5. Enter exercise details (only applicable for ISO and NSO grants)

When adding your grant details (see step 3), if you indicated that you have exercised any options from the grant, you will be prompted to enter the exercise details.

If you have indicated that your grant is early exercisable, you can add an exercise even if no options have vested yet.

If you have multiple exercises, you can enter them one at a time.

After entering your exercise information, you can choose from the following options:

- Save: Select this option if you have finished adding all of your exercises.

- Save and add more: Select this option if you have multiple exercises and want to add another one.

- Skip: Select this option if you do not wish to add an exercise.

Note that the total number of exercised options cannot exceed:

Note that the total number of exercised options cannot exceed:

- The total number of options vested as of the date of exercise, if early exercise is not allowed.

- The total number of options granted, if early exercise is allowed.

Once you have successfully completed all the steps above, your equity is now available across the Secfi platform 😊 🎉